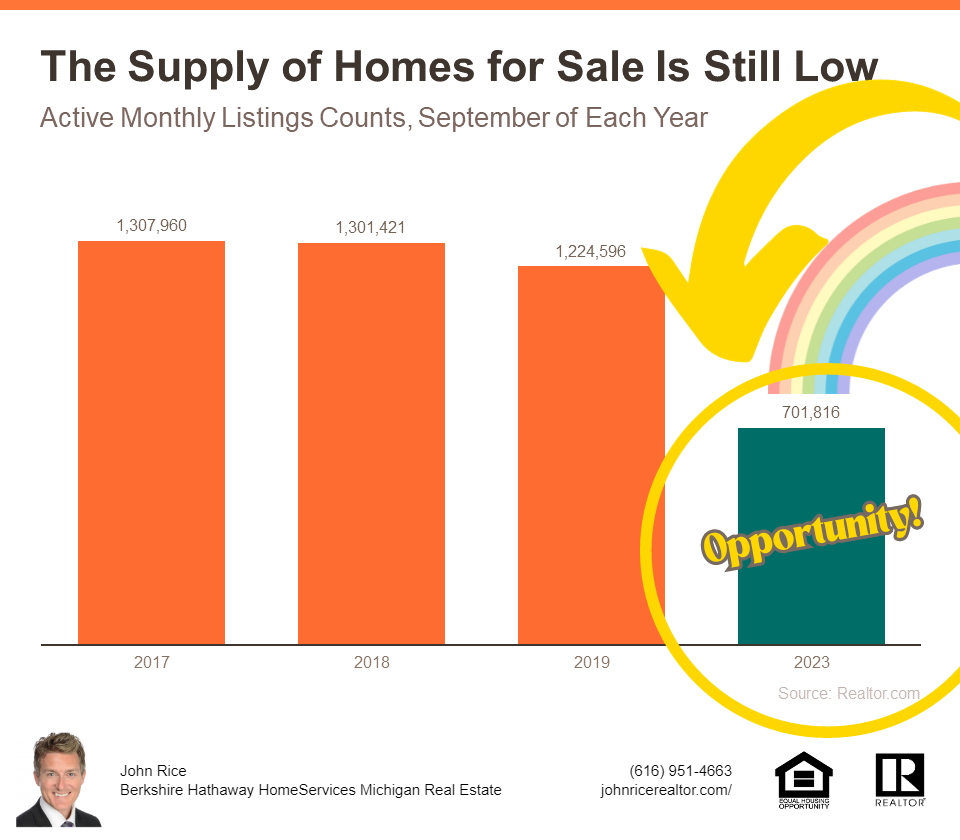

Why Today’s Housing Supply Is a Sweet Spot for Sellers Wondering if it still makes sense to sell your house right now? […]

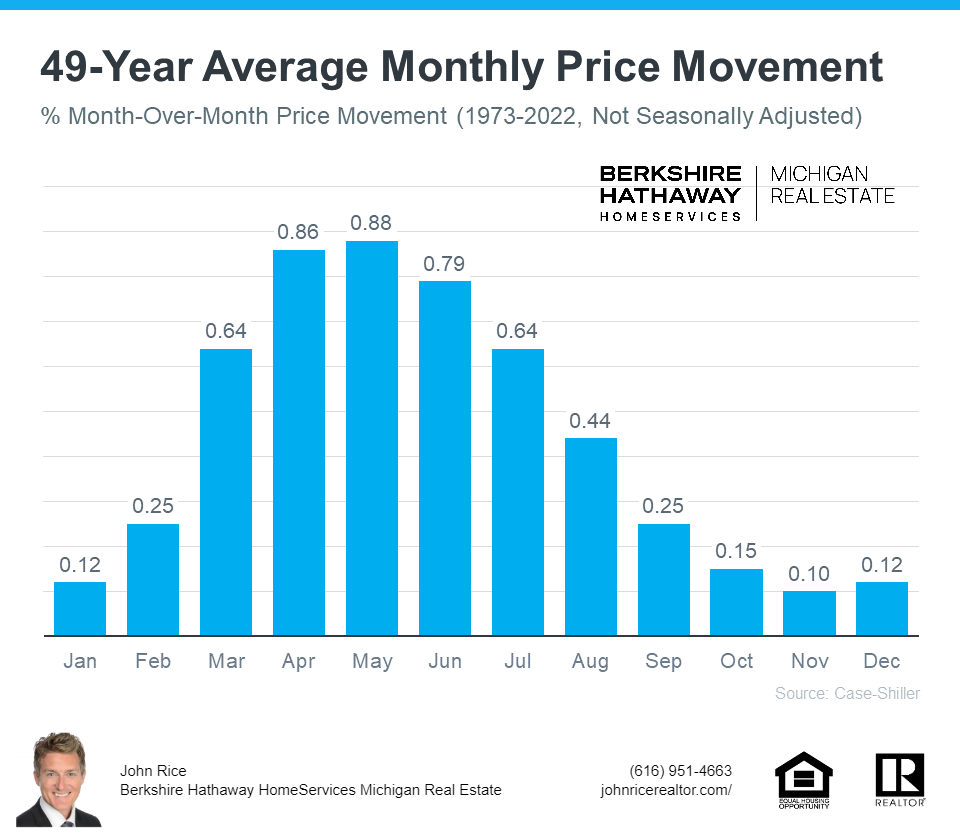

2 Reasons Why Today’s Mortgage Rate Trend Is Good for Sellers If you’ve been holding off on selling your house […]

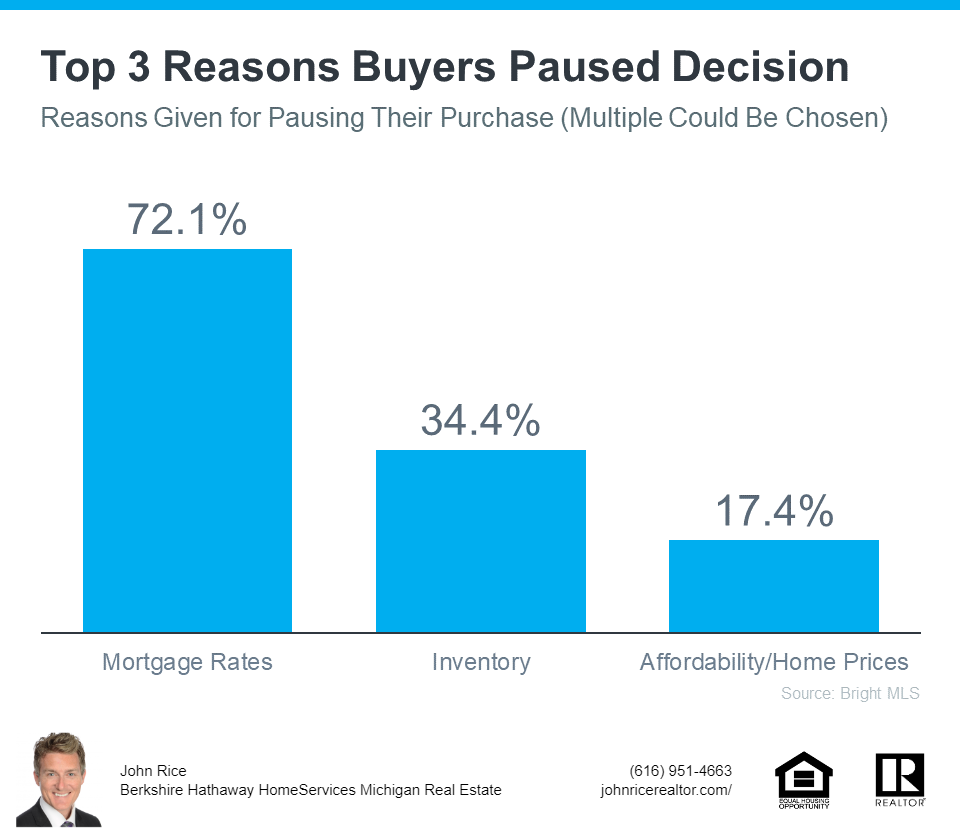

Are the Top 3 Housing Market Questions on Your Mind? When it comes to what’s happening in the housing market, […]

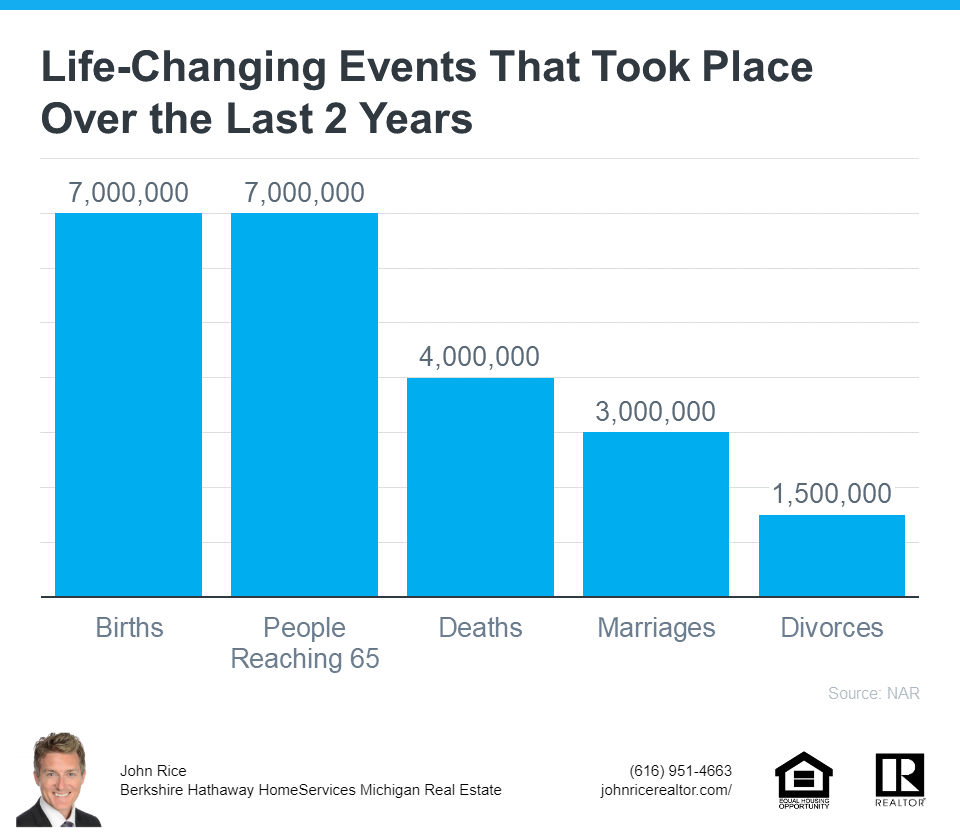

Life is a journey filled with unexpected twists and turns, like the excitement of welcoming a new addition, retiring and […]

When it comes to selling your house, you’re probably trying to juggle the current market conditions and your own needs […]

If you’re thinking of making a move, one of the biggest questions you have right now is probably: what’s happening […]

{$inline_image} Remote Work Is Changing How Some Buyers Search for Their Dream Homes The way Americans work has changed in […]

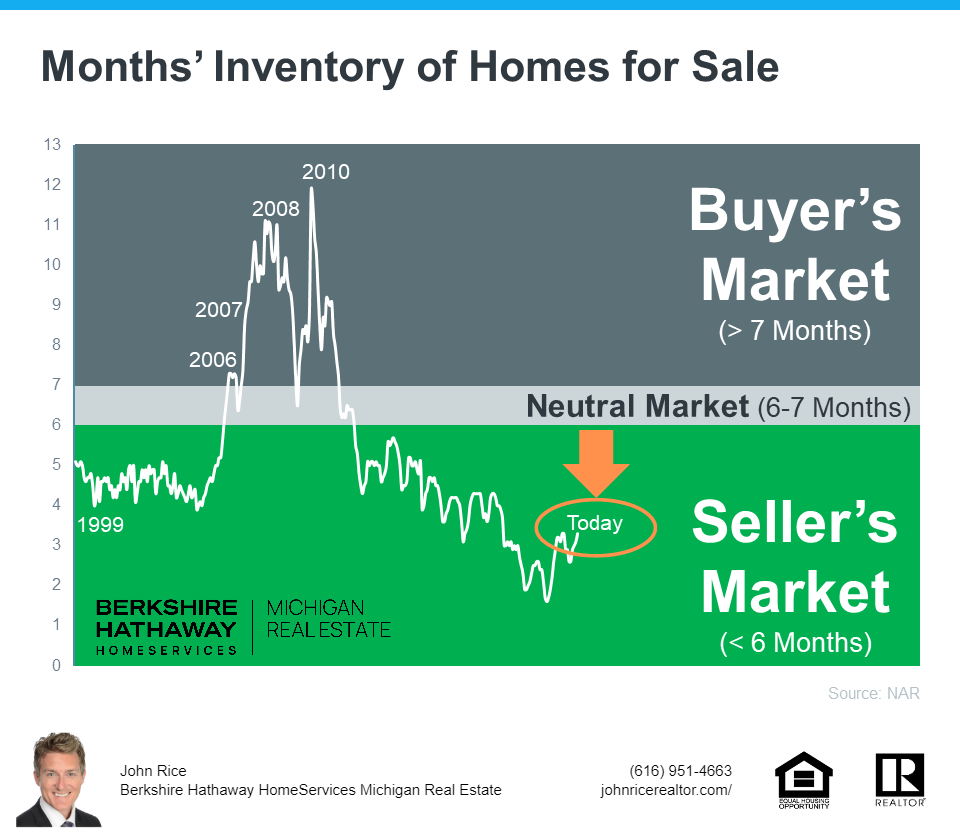

Why It’s Still a Seller’s Market Today Even though activity in the housing market has slowed from the frenzy that […]

Why the Median Home Price Is Meaningless in Today’s Market The National Association of Realtors (NAR) will released its latest […]

Homeownership Helps Protect You from Inflation [INFOGRAPHIC] Some Highlights Wondering if it makes sense to buy a home today even […]